Forecasting

The Aegis forecasting process combines four fundamental forecast components: robust data analytics, expert judgement regarding the specific industry and situation, risk management via comprehensive scenario simulations, and ongoing review and evaluation of model results and actual outcomes.

Many people liken forecasting to reading a crystal ball. Indeed, forecasts cannot achieve the predictability of historical analysis. However, by integrating formulation, application, and review, our forecasts bring insight and clarity to the process you are studying.

Our analysts have experience applying a wide variety of forecast models, including

-

Statistical end use modeling;

-

ARIMA models (auto-regressive integrated moving average);

-

Distributed lag models;

-

Multivariate models;

-

Structural change models;

-

Spline regression models.

Aegis has prepared forecasting models that:

-

Evaluate statistical end use forecast for multi-state electric utility with $18 billion in annual operating revenue.

-

Estimate impact of price change on demand for solid waste service using price elasticity model.

-

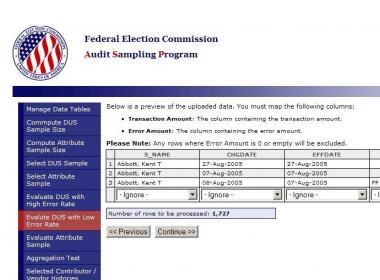

Develop data cleaning algorithm to identify billing errors in 32 million records.

-

Generate 600,000 customer specific weather response estimates for natural gas distribution company.

-

Forecast expected service life and retirement dispersion patterns for industrial assets.

-

Use Polynomial Distributed Lag model to characterize the evolution of electricity demand in response to price changes.

-

Forecast non-linear heating response with spline regression.

-

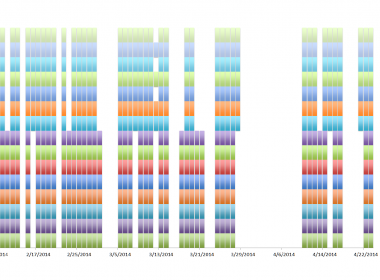

Utilize day of month variation in meter reading days to convert monthly data into daily natural gas forecast data.

-

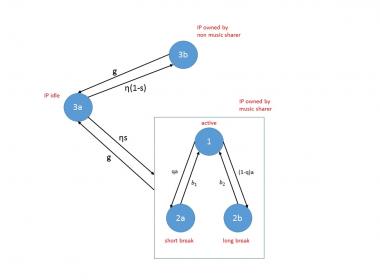

Use judgemental forecasting to identify EPA regulatory scenarios in coal plant retirement analysis.

-

Model integrated resource plan for regulatory hearings, including Monte Carlo simulation of risk and externalities to calculate levelized cost for resource evaluation.

-

Estimate future lost earnings and mitigating earnings for damage calculation.